21/09/2022

Max Darer, Lowes Financial Management

What do we prefer?

Lowes have been reviewing the structured product market for over 20 years, with an increasing database of over 8,500 products. Since 2000 we have been publicly identifying which new offers we ‘Prefer’ and our selection process has stood the test of time, as demonstrated in our annual performance reviews. Our methodology for identifying ‘Preferred’ solutions is based upon research and cross referencing against other available structured investments to distinguish which are, in our opinion the best value and considering our market viewpoint at the time.

Currently, there are a number of available plans that we have marked as ‘Preferred’, representing a mix of capital at risk and capital protected deposit-based plans.

The following plans offer an insight into what we currently ‘Prefer’, focusing solely on the capital-at-risk space in this instance.

Data sourced from StructuredProductReview.com.

|

Name |

Counterparty |

Underlying Index |

Shape |

Potential Gain Each Year |

Maximum Term |

Protection level as % of start level |

|

Walker Crips UK Annual Kick-Out Plan (GS172) |

Goldman Sachs |

FTSE 100 Index |

At-the-money |

8.75% |

6 years |

60% |

|

Walker Crips UK Step Down Kick-Out Plan (CT055) |

Citigroup |

FTSE 100 Index |

Step down |

8% |

7 years |

65% |

|

Walker Crips UK 95% Annual Kick-Out Plan (CT053) |

Citigroup |

FTSE 100 Index |

Defensive |

8.5% |

8 years |

65% |

|

Mariana 10:10 Plan November 2022 (Option 2) |

Morgan Stanley |

FTSE CSDI |

At-the-money |

11% |

10 years |

70% |

Walker Crips UK Annual Kick-out Plan (GS172)

Backed by Goldman Sachs, this maximum six-year plan features the potential to mature on any of the plan's anniversaries from year two onwards. Early maturity will be triggered provided that the FTSE 100 Index closes at a level equal to, or higher than the Initial Index Level, returning the capital investment in full, plus an 8.75% gain for each year the plan has been in force.

Walker Crips UK Step Down Kick Out Plan (CT055)

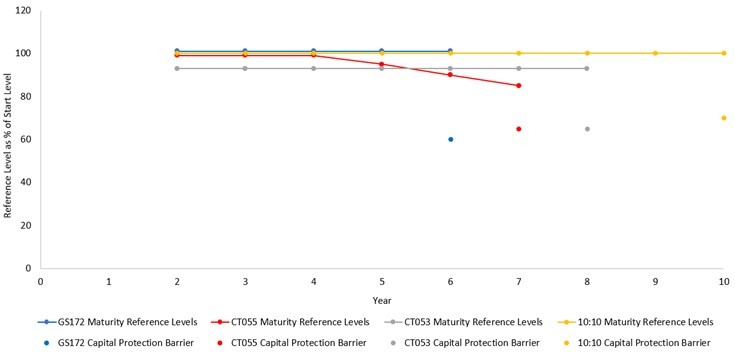

Backed by Citigroup, this maximum seven-year plan features the potential to mature on any anniversary from year two onwards, with an 8% gain for each year held. Early maturity will be triggered provided that the FTSE 100 Index closes at, or above, a reducing reference level. The Reference Level in years two, three and four is 100% of the Initial Index Level and this level is reduced by 5% on each subsequent anniversary and so will be 95%, 90%, and 85% of the initial level for years five, six and seven respectively.

Walker Crips UK 95% Annual Kick-Out Plan (CT053)

Again backed by Citigroup, this maximum eight-year plan features the potential to mature on any of the plan's anniversaries from year two onwards. Early maturity will be triggered provided that the FTSE 100 Index closes at a level equal to, or higher than 95% of the Initial Index Level, returning the capital investment in full, plus an 8% gain for each year the plan has been in force.

Mariana 10:10 Plan November 2022 (Option 2)

Backed by Morgan Stanley & Co. International plc this maximum ten-year and two-week plan features the potential to mature on any of the plan's anniversaries from year two onwards, provided that the FTSE CSDI closes at a level equal to, or higher than the Initial Index Level, returning the capital investment in full, plus an 11% gain for each year the plan has been in force.

The FTSE CSDI (FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index) is effectively the FTSE 100 total return index from which 3.5% per annum is deducted, this being the long-term average dividend yield of the shares in the FTSE 100 index. The FTSE CSDI, which is approximately 99% correlated with the FTSE 100 Index, will underperform the FTSE 100 if the annual dividends are less than 3.5% and out-perform if they are more. Even though the current forecast is that FTSE 100 dividend yield will be slightly higher than 3.5%, some counterparties still offer enhanced coupons for plans linked to this index because they do not need to factor in any margin for a potential fall in dividends.

The chart below illustrates the maturity trigger levels for each plan, along with the relevant capital protection barrier.

Data sourced from StructuredProductReview.com.

For full details on all available products, including those we ‘Prefer’, please click here. The Mariana 10:10 Plan November 2022 will be available on StructuredProductReview.com in the next week.

Structured investments put capital-at-risk.

Disclosure of interests: Lowes has provided input into the concept, development, promotion and distribution of the 10:10. Lowes has a commercial interest in these investments as a result of its involvement. Where Lowes is involved in advice on these investments to retail clients, it will not receive benefit of any fees for its involvement, other than those fees payable by the client to Lowes.

Also in this section

- Return of Nikkei

- Q1 2024 issuance

- Q1 2024 maturity results

- Structured Products – AAAAAGH!

- Hop in CIBC

- Re-enter Santander

- How to build a financial fortune - revisited

- Issuance in 2023

- Where's the risk?

- Questionable offerings

- Challenging the case against structured products - 'Loss of dividends'

- Navigating the investment landscape

- Challenging the case against structured products - Counterparty risk

- 6-year autocalls approaching final destination

- 1,750 FTSE capital at risk autocall maturities

- The leopard that changed her spots

- Q3 2023

- Challenging the case against structured products - Keydata

- Dilemmas for UK IFA's and the unique role of Structured Products

- 'High charges'

- Precipice bonds

- Intro

- FTSE 100 Contingent Income

- Indexing the indices

- Something different

- Investing through volatility

- 100 10:10s

- The best or worst?

- The 10%/25% 'Rule' that never was

- Structured products and the yield curve

- Fixed income: Capital at risk?

- Prospects for UK inflation - and fun with A.I!

- The Barrier Debate

- More Deposits for now

- Last of the Americans

- What if?

- Time heals all wounds, we hope...

- How to diversify portfolios using structured products?

- The Proof Is In The Pudding...

- Debunking Structured Misconceptions

- 1,500 FTSE Capital-at-Risk Autocall Maturities

- Q3 2022 Maturity Results

- What do we prefer?

- Deposits vs Capital ‘Protected’

- There’s time yet…

- Where did you invest your clients?

- A Six-Month Reflection

- Return of the Rev Con

- Happy 2nd Birthday FTSE CSDI

- Q2 2022 Maturity Results

- The best and worst yet still the best

- Critique my Suitability - Mariana 10:10 Plan June 2022 (Option 2)

- 10/10 for 55 10:10’s

- Q1 2022 Maturity Results

- 'How to build a financial fortune': a follow up

- Critique my Suitability - Mariana 10:10 Plan April 2022 (Option 2)

- 2021 Capital-at-Risk Autocall Maturity Review

- An unwelcome return...

- CSDI's First Birthday

- Bon Anniversaire

- Introducing the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index

- Q3 2021 Maturity Results

- Critique my Suitability - Mariana 10:10 Plan October 2021 (Option 2)

- Blurring the lines...

- Beware of false knowledge; it is more dangerous than ignorance

- Good news, bad news...

- Certainty is Certainly a Benefit

- Critique my Suitability - Mariana 10:10 Plan September 2021 (Option 2)

- A Twenty-Year Progression

- Q2 2021 Maturity Results

- Nine 8:8s Post Positive Returns in Falling Markets

- Critique my Suitability

- Q1 2021 Maturity Results

- Morgan Stanley’s Marvelous Maturity Medley

Current Products

We review the UK's retail structured investment sector, providing pertinent support for Professional Advisers and relevant research tools.

View all ⟶