First published 18/05/2022

Josh Mayne, Lowes Financial Management

The Mariana 10:10 Plan May 2019 (Option 1 & 2) successfully matured early on their third anniversary (10th May 2022), making them the 54th and 55th FTSE only 10:10 Plans to mature; the first being in October 2018. The plans matured returning an annualised return of 7.6% and 9.8% respectively, despite the FTSE 100 Index being up by just 0.55% over the three-year term.

All of the 55 maturing 10:10 Plans thus far did so successfully with investor’s capital earning an average annualised return of 8.56% across average term of three years – outperforming the sub sector average annualised returns during the same period by 1.26%pa.

All data sourced from StructuredProductReview.com. ‘All Products’ refers to all capital-at-risk autocall products linked solely to the FTSE 100 Index, maturing between October 2018 and May 2022.

|

|

All Products |

10:10 Plans |

|

Number of maturing products |

568 |

55 |

|

Number returning a positive outcome |

568 |

55 |

|

Number returning capital only |

0 |

0 |

|

Number returning a loss |

0 |

0 |

|

Average total gain |

17.95% |

26.68% |

|

Average term (years) |

2.4 |

2.93 |

|

Average annualised returns |

7.30% |

8.56% |

|

Average annualised returns upper quartile |

9.58% |

10.99% |

|

Average annualised return lower quartile |

5.59% |

6.50% |

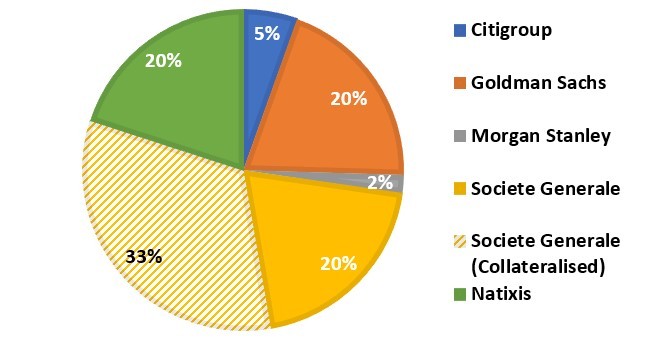

Counterparty banks utilised by all 10:10 Plan maturities to date

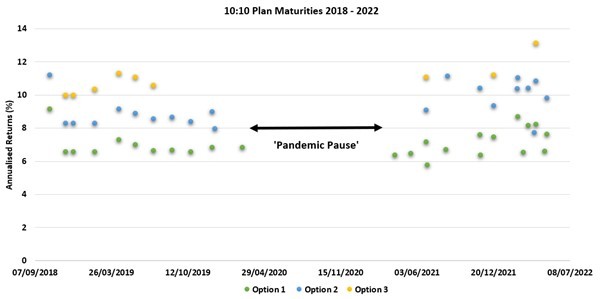

10:10 Plan maturities, as with the wider sector benefited from the side effects of coronavirus, with the ‘pandemic pause’ mirroring a difficult period for the UK stock market. 28 10:10 Plans matured before March 2020, with all those over the following thirteen months benefiting from an extra year’s deferment. No FTSE only autocall plans saw their underlying Index reach their respective kick-out reference levels between March 2020 and January 2021, and so continued onto the next observation date, accumulating a further potential coupon.

Reflecting the risk return trade off, the Option 3 (hurdle) returns are generally higher than the Option 2 (at-the-money) and Option 1 (step down) returns, reflecting the higher level of risk. There have however been less of the former reflecting at least an element of that risk; by design, the hurdle contracts are expected to have longer durations and a deferred maturity decreases the potential for them to mature positively.

That said, a key feature of the 10:10 Plan is that it has an extended maximum term of ten years, which should provide more time for an ultimate positive maturity when investors will be rewarded well for their time in the market.

The latest in the 10:10 series, Mariana 10:10 Plan June 2022 (Option 2), strikes on 17th June 2022. Investors in this Plan can find reassurance in knowing that if global stockmarkets collapsed shortly after strike, there would be more than nine years for the market to recover in order to trigger a positive maturity.

Even assuming a sustained bear market for the remainder of the investment term, a function of the 30% European capital protection barrier means that the 10:10 Plan will still return investors’ original capital in full, provided the Index closes no more than 30% below the June 2022 level on 17th June 2032. Otherwise, the plan will mature tracking the fall on a 1:1 basis.

The returns are attractive, the counterparty banks are strong, the protection is defined, the future is uncertain, 10:10 Plans provide peace of mind and annual focal points.

Full details of all three Options of the Mariana 10:10 Plan June 2022 can be found here, however a summary Option 2 is as below.

v Underlying Index: FTSE CSDI (The FTSE 100 can be followed as a rough proxy)

v Investment start date: 17th June 2022

v First possible maturity on 2nd anniversary and every year thereafter

v Early maturity triggered by the index being above the initial index level

v 20.5% gain (10.25% per year) payable if maturity triggered on 2nd anniversary

v 10.25% more (not compounded) for each further year i.e., maturity at five years pays 51.25%

v 10-year maximum term

v Capital at risk barrier: 70% of the 17th June 2022 FTSE CSDI level

v Capital at risk barrier observation date: 17th June 2032 (only if not matured sooner)

v Minimum investment £10,000

v Counterparty: Morgan Stanley & Co. International: ‘A+’ (Strong) rated by major credit rating agencies

The June 2022 issue of the 10:10 Plan uses a variation of the FTSE 100 Index – the FTSE CSDI, which tracks the same shares in the same proportions and is expected to continue to be very closely correlated to the FTSE 100 if the dividend yield of the shares in the index are in line with the 20-year average of 3.5% per annum. For full details on the FTSE CSDI, and the rationale being its inclusion, please reference the 10:10 literature.

Structured investments put capital at risk.

Past performance is not a guide to future performance.

Disclosure of interests: Lowes has provided input into the concept, development, promotion and distribution of the 10:10. Lowes has a commercial interest in these investments as a result of its involvement. Where Lowes is involved in advice on these investments to retail clients, it will not receive benefit of any fees for its involvement, other than those fees payable by the client to Lowes.

Also in this section

- 2,000 and counting

- Q2 2024 maturity results

- 20 years of autocall maturities

- Product focus - June 2024

- Fixed income or interest?

- Maturities of the month - May 2024

- The barrier debate - revisited

- Product focus - April 2024

- Maturities of the month - April 2024

- Time to call

- I don't believe markets are ever too high for Structured products!

- Notes on counterparty exposure

- Return of Nikkei

- Q1 2024 issuance

- Q1 2024 maturity results

- Structured Products – AAAAAGH!

- Hop in CIBC

- Re-enter Santander

- How to build a financial fortune - revisited

- Issuance in 2023

- Where's the risk?

- Questionable offerings

- Challenging the case against structured products - 'Loss of dividends'

- Navigating the investment landscape

- Challenging the case against structured products - Counterparty risk

- 6-year autocalls approaching final destination

- 1,750 FTSE capital at risk autocall maturities

- The leopard that changed her spots

- Q3 2023

- Challenging the case against structured products - Keydata

- Dilemmas for UK IFA's and the unique role of Structured Products

- 'High charges'

- Precipice bonds

- Intro

- FTSE 100 Contingent Income

- Indexing the indices

- Something different

- Investing through volatility

- 100 10:10s

- The best or worst?

- The 10%/25% 'Rule' that never was

- Structured products and the yield curve

- Fixed income: Capital at risk?

- Prospects for UK inflation - and fun with A.I!

- The Barrier Debate

- More Deposits for now

- Last of the Americans

- What if?

- Time heals all wounds, we hope...

- How to diversify portfolios using structured products?

- The Proof Is In The Pudding...

- Debunking Structured Misconceptions

- 1,500 FTSE Capital-at-Risk Autocall Maturities

- Q3 2022 Maturity Results

- What do we prefer?

- Deposits vs Capital ‘Protected’

- There’s time yet…

- Where did you invest your clients?

- A Six-Month Reflection

- Return of the Rev Con

- Happy 2nd Birthday FTSE CSDI

- Q2 2022 Maturity Results

- The best and worst yet still the best

- Critique my Suitability - Mariana 10:10 Plan June 2022 (Option 2)

- 10/10 for 55 10:10’s

- Q1 2022 Maturity Results

- 'How to build a financial fortune': a follow up

- Critique my Suitability - Mariana 10:10 Plan April 2022 (Option 2)

- 2021 Capital-at-Risk Autocall Maturity Review

- An unwelcome return...

- CSDI's First Birthday

- Bon Anniversaire

- Introducing the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index

- Q3 2021 Maturity Results

- Critique my Suitability - Mariana 10:10 Plan October 2021 (Option 2)

- Blurring the lines...

- Beware of false knowledge; it is more dangerous than ignorance

- Good news, bad news...

- Certainty is Certainly a Benefit

- Critique my Suitability - Mariana 10:10 Plan September 2021 (Option 2)

- A Twenty-Year Progression

- Q2 2021 Maturity Results

- Nine 8:8s Post Positive Returns in Falling Markets

- Critique my Suitability

- Q1 2021 Maturity Results

- Morgan Stanley’s Marvelous Maturity Medley

Current Products

We review the UK's retail structured investment sector, providing pertinent support for Professional Advisers and relevant research tools.

View all ⟶