First Published on 02/11/2022

Whilst slightly late to the party, we have recently discovered an article published on The Evidence Based Investor back in November 2019 entitled “A warning on structured products”, which provides a scathing criticism of structured products, warning of their “dangers” as “opaque and complicated” investments whereby “the risks… far outweigh their benefits”. The author insists that it would be “very difficult (if not impossible) … to prove [him] wrong”; so, we thought we’d have a go…

The author lists four main ‘problems’ with structured products as part of an anecdotal conversation with a financial adviser.

“They are complicated and not always designed to be in the best interests of investors.”

Firstly, one of the more common criticisms levied against structured products, is their perceived complexity as a consequence of their utilisation of derivative contracts. However, concerns over complexity of construction should not blind advisers and investors alike to the benefits of using structured products in retail client portfolios, particularly where the simplicity of defined outcomes are clear.

Collective investment schemes have become a mainstay in the UK investment arena, although despite being comfortable with the concept, how many of us truly understand any of the complexity that is going on behind the scenes? What we do know is that structured products, like fixed-rate bonds, are a “contract” where the issuer is obliged to deliver exactly what is says. The contract may not always deliver a gain, but we know the circumstances in which this will be the case.

Of course, there have been some structured products which could have been fairly described as complicated, but this is far from the case with the vast majority of the UK retail sector which offer clearly defined outcomes, delivered at defined dates, in defined circumstances.

As for structured products ‘not always being designed in the best interests of investors’, again, there have been some for which such criticism might be justified, but beyond that this statement is incorrect. Under the the FCA’s framework surrounding retail investments, firms are required to “identify the target market and then design products that meet the needs of end customers in that target market”. The structured products offered in today’s market comply with this requirement and we are confident that investors and advisers who have experience of the sector would, in the main, argue that their experience has been that structured products have indeed been in the investors interests.

“The risk/reward ratio is simply poor.”

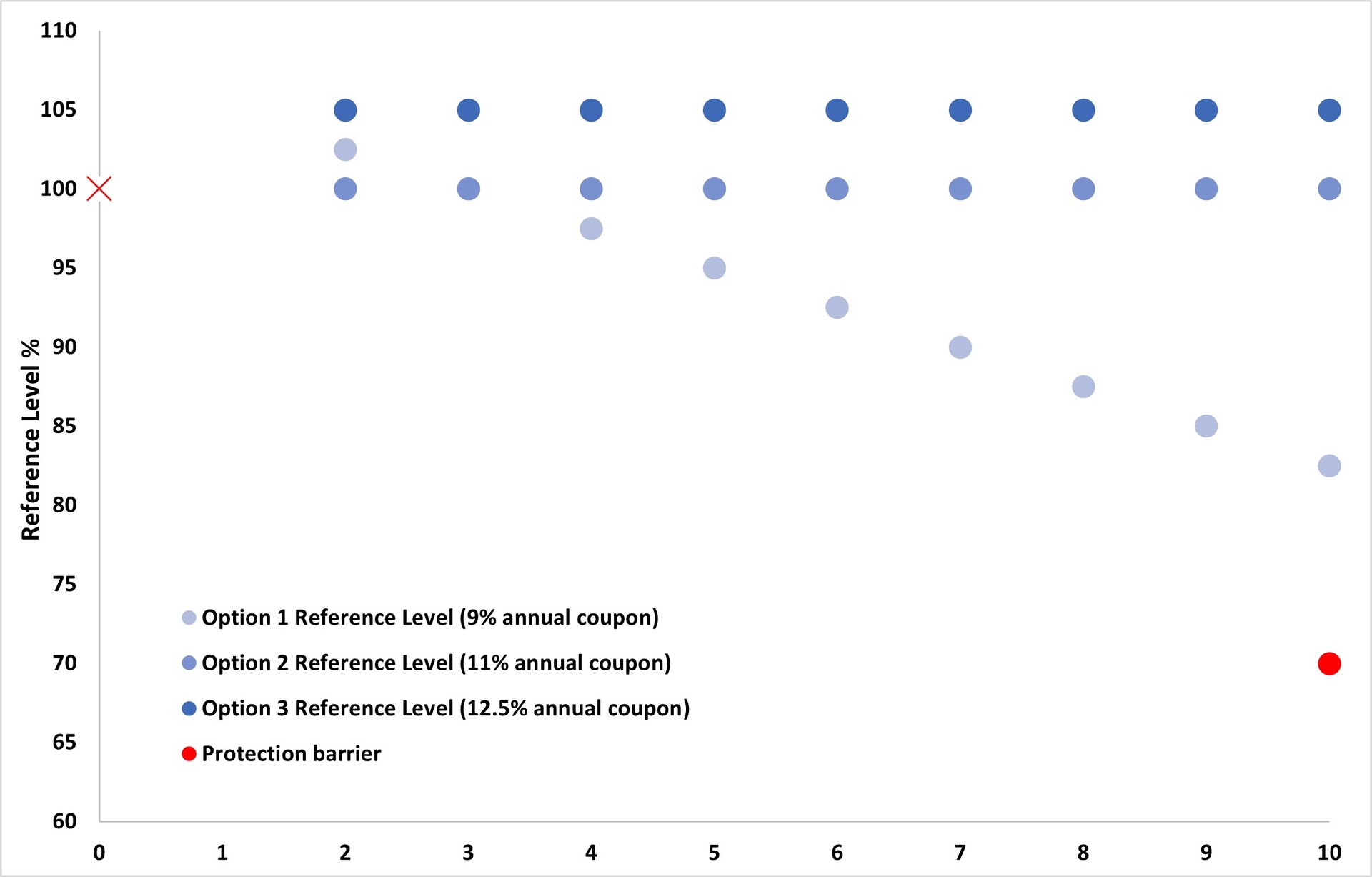

This statement is impulsive and sweeping. Figure 1 illustrates the three options of the latest 10:10 Plan, representing a defensive strategy, a conservative strategy and a moderately optimistic strategy.

Payoff profiles of the November 2022 10:10 Plan (Options 1, 2 and 3)

As observable, structured products can come in different shapes with different risk/reward tradeoffs. The level of downside protection, the underlying(s) on which the performance is derived and the level and frequency of early maturity reference levels can all influence the degree of risk taken, and therefore impact the coupon being offered. For example, a plan that is linked to the performance of more than one underlying, requiring the underlyings to have risen by at least 5% on an observation date and with a higher capital protection barrier is riskier and will offer a larger coupon than a more vanilla contract linked to a single index, which will mature successfully in flat, or falling markets with greater protection offered.

The point here being that investors can tailor the degree of risk taken through product selection, as with any other investment – some will be riskier than others, but in the vast majority of instances the risk/reward ratio is clear and for today’s UK retail structured products, is rarely poor.

To illustrate, by reference to the latest 10:10 Plans, research by Future Value Consultants [1] shows a back tested probability of a positive outcome for all three options of 100% and a simulated probability of positive outcome of 93.03%, 91.05% and 88.73% for options one, two and three respectively. With returns of 9%, 11% and 12.5% for each year held for the three options respectively, we would strongly contest the opinion that the risk reward ratio is anything but good.

“The truth is that on a historical basis, the downside protection of these notes is limited, and at the same time, the upside potential is capped.”

Whilst it is irrefutable that a typical capital-at-risk structured product in the UK retail sector will offer capped upside and limited, contingent downside protection, the statement above is misleading. Of course, if markets were to go on a significant bull run with equity indices soaring, investors would have been better served in an uncapped fund. Similarly, if markets plummeted under adverse conditions, resulting in the capital protection barrier being breached resulting in a loss, investors would have been better served in an investment offering full capital protection.

A typical capital protection barrier allows the underlying to fall by up to that percentage at maturity, without original capital being reduced. Although not 100% protected, this allows investors a degree of security and peace of mind that they wouldn’t have through investment in a collective investment fund. Similarly, despite being capped, autocall plans, which are the mainstay of the UK retail structured product sector can mature in flat or falling markets with handsome gains. Referring back to the risk/reward ratio, investors are sacrificing uncapped upside for a degree of capital protection and increased likelihood of positive performance.

The truth is that on a historical basis looking at the first 1,500 capital-at-risk autocall structured products linked solely to the FTSE 100 Index (the mainstay of the UK retail sector) to mature in the UK retail space [2] , 99.5% matured with a gain. The remaining ½% (eight plans) matured in 2011 – 2013, returning investors’ original capital in full, but with no gain or loss. Collectively the 1,500 plans realised an average annualised return of 7.75% over an average term of just over two years.

And herein lies the evidence that underlines the defense to the flawed arguments presented in the original article. Looking at the mainstay of the UK retail sector; capital at risk FTSE linked autocalls, 99.5% of all maturing products over the last eighteen years have successfully produced a gain, with an average annualised return of 7.75% per annum. As mentioned earlier, there are exceptions outside of the vanilla side of the sector, but in the main the evidence is explicit and we feel clearly proves the author of the original article to have been somewhat misinformed, at best.

Structured products have and will continue to serve investors well as part of a well-diversified portfolio, and we hope to see less and less misinformed opinions clouding the performance of the sector.

* Sources

1 https://www.structurededge.co.uk/makereport.cfm?reportnumber=6783

https://www.structurededge.co.uk/makereport.cfm?reportnumber=6784

https://www.structurededge.co.uk/makereport.cfm?reportnumber=6785

2 https://www.structuredproductreview.com/education/articles/1500-ftse-car-autocall-maturities/

Past performance is not a guide to the future.

Structured investments place capital-at-risk.

Disclosure of interests: Lowes has provided input into the concept, development, promotion and distribution of the 10:10. Lowes has a commercial interest in these investments as a result of its involvement. Where Lowes is involved in advice on these investments to retail clients, it will not receive benefit of any fees for its involvement, other than those fees payable by the client to Lowes.

Also in this section

- 2,000 and counting

- Q2 2024 maturity results

- 20 years of autocall maturities

- Product focus - June 2024

- Fixed income or interest?

- Maturities of the month - May 2024

- The barrier debate - revisited

- Product focus - April 2024

- Maturities of the month - April 2024

- Time to call

- I don't believe markets are ever too high for Structured products!

- Notes on counterparty exposure

- Return of Nikkei

- Q1 2024 issuance

- Q1 2024 maturity results

- Structured Products – AAAAAGH!

- Hop in CIBC

- Re-enter Santander

- How to build a financial fortune - revisited

- Issuance in 2023

- Where's the risk?

- Questionable offerings

- Challenging the case against structured products - 'Loss of dividends'

- Navigating the investment landscape

- Challenging the case against structured products - Counterparty risk

- 6-year autocalls approaching final destination

- 1,750 FTSE capital at risk autocall maturities

- The leopard that changed her spots

- Q3 2023

- Challenging the case against structured products - Keydata

- Dilemmas for UK IFA's and the unique role of Structured Products

- 'High charges'

- Precipice bonds

- Intro

- FTSE 100 Contingent Income

- Indexing the indices

- Something different

- Investing through volatility

- 100 10:10s

- The best or worst?

- The 10%/25% 'Rule' that never was

- Structured products and the yield curve

- Fixed income: Capital at risk?

- Prospects for UK inflation - and fun with A.I!

- The Barrier Debate

- More Deposits for now

- Last of the Americans

- What if?

- Time heals all wounds, we hope...

- How to diversify portfolios using structured products?

- The Proof Is In The Pudding...

- Debunking Structured Misconceptions

- 1,500 FTSE Capital-at-Risk Autocall Maturities

- Q3 2022 Maturity Results

- What do we prefer?

- Deposits vs Capital ‘Protected’

- There’s time yet…

- Where did you invest your clients?

- A Six-Month Reflection

- Return of the Rev Con

- Happy 2nd Birthday FTSE CSDI

- Q2 2022 Maturity Results

- The best and worst yet still the best

- Critique my Suitability - Mariana 10:10 Plan June 2022 (Option 2)

- 10/10 for 55 10:10’s

- Q1 2022 Maturity Results

- 'How to build a financial fortune': a follow up

- Critique my Suitability - Mariana 10:10 Plan April 2022 (Option 2)

- 2021 Capital-at-Risk Autocall Maturity Review

- An unwelcome return...

- CSDI's First Birthday

- Bon Anniversaire

- Introducing the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index

- Q3 2021 Maturity Results

- Critique my Suitability - Mariana 10:10 Plan October 2021 (Option 2)

- Blurring the lines...

- Beware of false knowledge; it is more dangerous than ignorance

- Good news, bad news...

- Certainty is Certainly a Benefit

- Critique my Suitability - Mariana 10:10 Plan September 2021 (Option 2)

- A Twenty-Year Progression

- Q2 2021 Maturity Results

- Nine 8:8s Post Positive Returns in Falling Markets

- Critique my Suitability

- Q1 2021 Maturity Results

- Morgan Stanley’s Marvelous Maturity Medley

Current Products

We review the UK's retail structured investment sector, providing pertinent support for Professional Advisers and relevant research tools.

View all ⟶

Debunking Structured Misconceptions