1st July marked the second anniversary of the FTSE CSDI (Custom 100 Synthetic 3.5% Dividend Index).

The index was developed as an underlying for structured products by FTSE Russell, who also calculate and publish the FTSE 100 Index. The FTSE CSDI tracks the same 100 shares as the FTSE 100, in the same proportions but unlike the FTSE 100 the CSDI includes the benefit of the dividends paid by the companies (which have historically averaged around 3.5% per annum), and then deducts the equivalent to a fixed 3.5% dividend per annum, on a daily basis.

The benefit to the issuer of utilsing the index is that the issuing bank does not need to predict the level of dividends that will be produced throughout the term. Whilst the risk of variability is in turn accepted by the end investor to a degree, they benefit from the margin the issuer would otherwise have included to cover any shortfall in their predictions.

From a returns perspective the FTSE CSDI will perform almost identically to the FTSE 100 if dividends are at 3.5% pa, moderately underperform if they are less, and moderately overperform if they are more. Whilst the CSDI is quoted daily, the FTSE 100 Index serves as an approximate proxy as to performance.

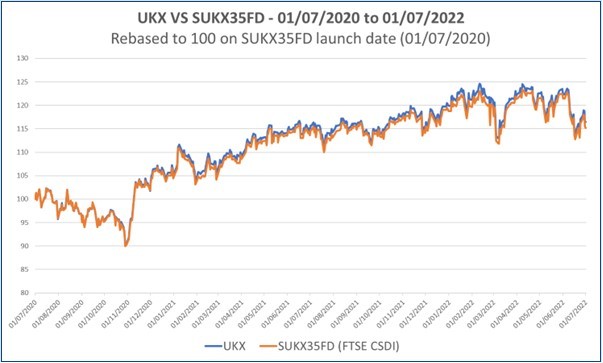

The following from Mariana and Bloomberg illustrates the performance of the CSDI relative to the FTSE 100 Index since 1st July 2020.

|

|

2 Years (01/07/2020 – 30/06/2022) |

1 Years (01/07/2021 – 30/06/2022) |

|

FTSE 100 Index |

+16.42% |

+0.62% |

|

FTSE CSDI |

+15.53% |

+0.66% |

|

CSDI / UKX Correlation* |

99.95% |

99.65% |

* This is based on simple return correlation not log return correlation.

The implied dividend yield of the FTSE 100 for 2022 is 3.25%; slightly below the 3.5% fixed dividend of CSDI (Bloomberg, 10th June 2022).

To provide an indication as to the uplift that utilsing the CSDI can bring when pricing the 10:10 Plan August 2022, Mariana obtained pricing for both the FTSE 100 and CSDI which showed an uplift in coupons of 1.3% to 2.4% per annum:

|

|

CSDI |

FTSE 100 |

|

10:10 Option 1 |

8.25% |

6.93% |

|

10:10 Option 2 |

10.25% |

8.11% |

|

10:10 Option 3 |

12.25% |

9.84% |

The first structured investments that utilised the CSDI are on track to mature this November – as indeed would have been the case had they been linked to the FTSE 100 Index but with a higher total return.

Full details of the latest 10:10 Plan, which is linked to the CSDI, can be found here.

Structured investments put capital-at-risk.

Past performance is not a guide to future performance.

Disclosure of interests: Lowes has provided input into the concept, development, promotion and distribution of the 10:10. Lowes has a commercial interest in these investments as a result of its involvement. Where Lowes is involved in advice on these investments to retail clients, it will not receive benefit of any fees for its involvement, other than those fees payable by the client to Lowes.

Also in this section

- 2,000 and counting

- Q2 2024 maturity results

- 20 years of autocall maturities

- Product focus - June 2024

- Fixed income or interest?

- Maturities of the month - May 2024

- The barrier debate - revisited

- Product focus - April 2024

- Maturities of the month - April 2024

- Time to call

- I don't believe markets are ever too high for Structured products!

- Notes on counterparty exposure

- Return of Nikkei

- Q1 2024 issuance

- Q1 2024 maturity results

- Structured Products – AAAAAGH!

- Hop in CIBC

- Re-enter Santander

- How to build a financial fortune - revisited

- Issuance in 2023

- Where's the risk?

- Questionable offerings

- Challenging the case against structured products - 'Loss of dividends'

- Navigating the investment landscape

- Challenging the case against structured products - Counterparty risk

- 6-year autocalls approaching final destination

- 1,750 FTSE capital at risk autocall maturities

- The leopard that changed her spots

- Q3 2023

- Challenging the case against structured products - Keydata

- Dilemmas for UK IFA's and the unique role of Structured Products

- 'High charges'

- Precipice bonds

- Intro

- FTSE 100 Contingent Income

- Indexing the indices

- Something different

- Investing through volatility

- 100 10:10s

- The best or worst?

- The 10%/25% 'Rule' that never was

- Structured products and the yield curve

- Fixed income: Capital at risk?

- Prospects for UK inflation - and fun with A.I!

- The Barrier Debate

- More Deposits for now

- Last of the Americans

- What if?

- Time heals all wounds, we hope...

- How to diversify portfolios using structured products?

- The Proof Is In The Pudding...

- Debunking Structured Misconceptions

- 1,500 FTSE Capital-at-Risk Autocall Maturities

- Q3 2022 Maturity Results

- What do we prefer?

- Deposits vs Capital ‘Protected’

- There’s time yet…

- Where did you invest your clients?

- A Six-Month Reflection

- Return of the Rev Con

- Happy 2nd Birthday FTSE CSDI

- Q2 2022 Maturity Results

- The best and worst yet still the best

- Critique my Suitability - Mariana 10:10 Plan June 2022 (Option 2)

- 10/10 for 55 10:10’s

- Q1 2022 Maturity Results

- 'How to build a financial fortune': a follow up

- Critique my Suitability - Mariana 10:10 Plan April 2022 (Option 2)

- 2021 Capital-at-Risk Autocall Maturity Review

- An unwelcome return...

- CSDI's First Birthday

- Bon Anniversaire

- Introducing the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index

- Q3 2021 Maturity Results

- Critique my Suitability - Mariana 10:10 Plan October 2021 (Option 2)

- Blurring the lines...

- Beware of false knowledge; it is more dangerous than ignorance

- Good news, bad news...

- Certainty is Certainly a Benefit

- Critique my Suitability - Mariana 10:10 Plan September 2021 (Option 2)

- A Twenty-Year Progression

- Q2 2021 Maturity Results

- Nine 8:8s Post Positive Returns in Falling Markets

- Critique my Suitability

- Q1 2021 Maturity Results

- Morgan Stanley’s Marvelous Maturity Medley

Current Products

We review the UK's retail structured investment sector, providing pertinent support for Professional Advisers and relevant research tools.

View all ⟶