Max Darer, Lowes Financial Management, 29/03/2023

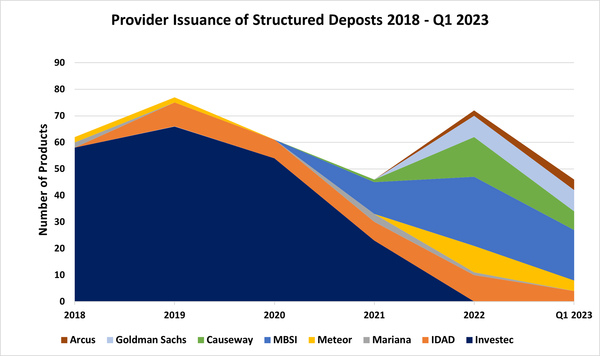

2022 was a captivating year for UK retail structured products, with total issuance having increased with a notable increase in deposit-based contracts. A structured deposit provides surety of a return of capital, with FSCS protection and will typically pay a fixed or variable interest payment dependent on the position of the defined underlying measure, often the FTSE 100 Index. Investec had been the predominant issuer of structured deposits in the UK for many years and following their exit from the market in February 2021, other sector participants have stepped up to fill the gap. A total of 72 deposit-based structured plans were issued in 2022 from seven different providers compared to just 46 plans issued from five providers in 2021. Already in 2023, 46 deposit-based plans have been issued by six providers.

In 2021 Lowes did not favour any deposit plan issued in the retail space but in 2022 we marked 18 new issue deposits as ‘Preferred’. 2022 saw the introduction of one particularly simple deposit shape being fixed income deposit plans. These are very similar to fixed term deposits with terms of four or five years, during which time they pay a fixed income and the potential for an added bonus at maturity if the underlying is higher. With interest payments offered being as high as 5.5% per annum plus potential bonus, these plans have been the best deposit offerings available for over a decade. As for 2023, there have been four fixed income plans released so far, none of which have impressed as much as those seen at the end of 2022. However, eight deposit plans have been marked as ‘Preferred’ so far.

The rise in structured deposits has been welcomed and is more encompassing to a wider range of investors. Of course, a deposit-based plan accepts a significantly lower level of risk than a capital at risk plan by providing protection against market and counterparty risk, but it has been the rise in the return aspect of the plans that has brought them back to the light and even made them a viable alternative to some capital-at-risk plans. In 2021, the average annualised return of maturing deposit plans was 2.13% - in 2022 we saw new issue structured deposits offer fixed returns of more than double this, and contingent returns of more than three times.

One of the fundamental benefits of structured deposits is the layer of protection offered through the Financial Services Compensation Scheme (FSCS), protecting up to £85,000 per bank, per individual. This is what fundamentally differentiates a deposit-based plan from a capital-protected plan, the latter does not protect the investment from a failure of the counterparty.

2022 saw a peak inflation figure of 11.1%, well over five times the Bank of England’s target rate of 2%. With tightening monetary policy since December 2021, the Base Rate rose from 0.1% to 4.25% with the stance that rates must remain high until inflation is under control.

All else equal as interest rates remain elevated, structured deposits will continue to offer attractive returns, something we are very much looking forward to seeing play out in 2023, securing them a place in many a portfolio.

Also in this section

- How old is too old? Are structured products to die for?

- Product focus - October 2024

- Q3 2024 Issuance

- Q3 2024 maturity results

- A share of spread bets on steroids?

- Product focus - September 2024

- Maturities of the month - August 2024

- Right on time

- Product focus - August 2024

- Keep calm and zoom out

- 2,000 and counting

- Q2 2024 maturity results

- 20 years of autocall maturities

- Product focus - June 2024

- Fixed income or interest?

- Maturities of the month - May 2024

- The barrier debate - revisited

- Product focus - April 2024

- Maturities of the month - April 2024

- Time to call

- I don't believe markets are ever too high for Structured products!

- Notes on counterparty exposure

- Return of Nikkei

- Q1 2024 issuance

- Q1 2024 maturity results

- Structured Products – AAAAAGH!

- Hop in CIBC

- Re-enter Santander

- How to build a financial fortune - revisited

- Issuance in 2023

- Where's the risk?

- Questionable offerings

- Challenging the case against structured products - 'Loss of dividends'

- Navigating the investment landscape

- Challenging the case against structured products - Counterparty risk

- 6-year autocalls approaching final destination

- 1,750 FTSE capital at risk autocall maturities

- The leopard that changed her spots

- Q3 2023

- Challenging the case against structured products - Keydata

- Dilemmas for UK IFA's and the unique role of Structured Products

- 'High charges'

- Precipice bonds

- Intro

- FTSE 100 Contingent Income

- Indexing the indices

- Something different

- Investing through volatility

- 100 10:10s

- The best or worst?

- The 10%/25% 'Rule' that never was

- Structured products and the yield curve

- Fixed income: Capital at risk?

- Prospects for UK inflation - and fun with A.I!

- The Barrier Debate

- More Deposits for now

- Last of the Americans

- What if?

- Time heals all wounds, we hope...

- How to diversify portfolios using structured products?

- The Proof Is In The Pudding...

- Debunking Structured Misconceptions

- 1,500 FTSE Capital-at-Risk Autocall Maturities

- Q3 2022 Maturity Results

- What do we prefer?

- Deposits vs Capital ‘Protected’

- There’s time yet…

- Where did you invest your clients?

- A Six-Month Reflection

- Return of the Rev Con

- Happy 2nd Birthday FTSE CSDI

- Q2 2022 Maturity Results

- The best and worst yet still the best

- Critique my Suitability - Mariana 10:10 Plan June 2022 (Option 2)

- 10/10 for 55 10:10’s

- Q1 2022 Maturity Results

- 'How to build a financial fortune': a follow up

- Critique my Suitability - Mariana 10:10 Plan April 2022 (Option 2)

- 2021 Capital-at-Risk Autocall Maturity Review

- An unwelcome return...

- CSDI's First Birthday

- Bon Anniversaire

- Introducing the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index

- Q3 2021 Maturity Results

- Critique my Suitability - Mariana 10:10 Plan October 2021 (Option 2)

- Blurring the lines...

- Beware of false knowledge; it is more dangerous than ignorance

- Good news, bad news...

- Certainty is Certainly a Benefit

- Critique my Suitability - Mariana 10:10 Plan September 2021 (Option 2)

- A Twenty-Year Progression

- Q2 2021 Maturity Results

- Nine 8:8s Post Positive Returns in Falling Markets

- Critique my Suitability

- Q1 2021 Maturity Results

- Morgan Stanley’s Marvelous Maturity Medley

Current Products

We review the UK's retail structured investment sector, providing pertinent support for Professional Advisers and relevant research tools.

View all ⟶