First published October 2020.

In the UK retail structured products sector the FTSE 100 Index has been the most commonly utilised underlying, accounting for 67% of issued plans in the previous decade (2010 – 2019). The index is comprised of the 100 largest companies listed on the London Stock Exchange, weighted by market capitalisation, and represents approximately 81% of the value of UK’s stock market. Linking the performance of structured products to the performance of the FTSE 100 Index allows investors exposure to the UK equity market, via its most widely quoted benchmark. The FTSE 100 is a ‘price return’ index, meaning that it only considers price movements of the of shares that it consists of – it does not reflect the dividends paid out by these companies.

The counterparty to a FTSE 100 linked structured product will however, base their terms on, amongst other things, the anticipated dividend yield that the shares in the FTSE 100 Index are expected to produce over the holding period. This requires a degree of forecasting and it is not unreasonable to expect the bank to err on the side of caution. As a result of the COVID-19 pandemic, indications are that more recent dividend estimates, even after accounting for a margin of error have proved to be a little on the high side. The market weighted dividend yield from the shares in the FTSE 100 in 2019 was 4.35% and the latest forecast yield for 2020 as a full year is now 3.5% (Professional Adviser). This decrease coupled with a higher than normal degree of uncertainty, making forecasting more difficult, to the extent that the banks will build in a higher than usual margin for error, has played a significant role in the coupons being offered on FTSE linked structures being substantially lower.

As the FTSE 100 dividend yield, and in turn FTSE linked product pricing, shows no sign of improving, this is where the FTSE Custom 100 Synthetic 3.5% Dividend Index (FTSE CSDI) comes into play…

FTSE Russell, who calculate and publish official figures for the FTSE 100 Index, have created the FTSE CSDI as a proxy for the FTSE 100, purpose built to be referenced as an underlying asset to structured investments.

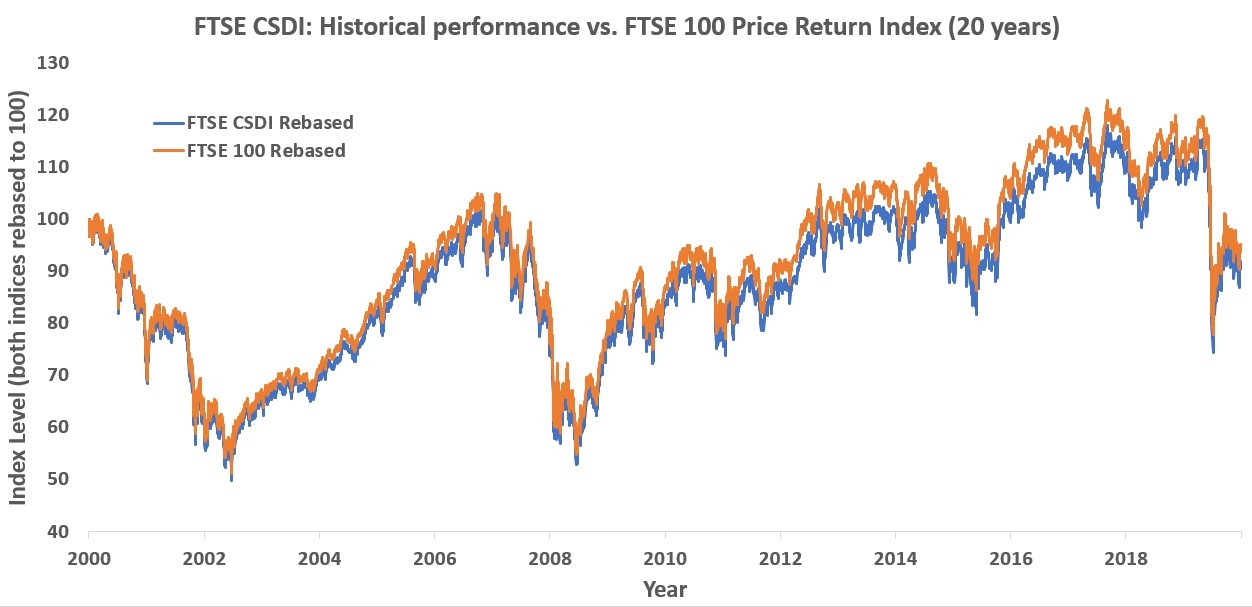

Whilst the FTSE CSDI will not replicate the price only performance of the FTSE 100 exactly, it aims to remain somewhat aligned to it via a two-step process;

1. It aims to replicate the total returns of the FTSE 100 constituent shares by reference to not only their capital value (the FTSE 100 Index), but also including the dividends generated and assumes reinvestment on the dividends.

2. In order to achieve alignment with the price only index, an annual dividend equivalent to 3.5% is deducted daily from the level of the index; the 20-year average dividend yield of the FTSE 100 shares is approximately 3.5%.

Therefore, if the dividend yield of the FTSE 100 shares is approximately 3.5% the fixed 3.5% annual drawdown will mean that the performance of the CSDI should be very close to that of the FTSE 100 Index, as indicated below. An advantage of taking a fixed percentage drawdown, rather than say a fixed index points drawdown, is that the dividend taken will remain proportionate to the index’s performance.

The FTSE CSDI offers investors exposure to same market, in the same proportions and its performance has been highly correlated to that of the FTSE 100 Index.

| 5 year | 99.912 |

| 10 year | 99.973 |

| 20 year | 99.971 |

The benefit of the FTSE CSDI as an underlying, over the FTSE 100 is that, for the counterparty bank, taking a fixed 3.5% ‘dividend’ drawdown removes the element of guess work regarding potential dividend yield, in turn allowing them to hedge more efficiently and more importantly, less expensively. This saving translates to improved potential coupons offered on FTSE CSDI contracts compared to equivalent FTSE 100 linked plans.

For example, the November 2020 tranche of the 10:10 Plan is a maximum ten-year capital-at-risk autocall contract, where the first kick out observation point is at the end of year two, and annually thereafter. The plan offers capital protection to investors against a fall in the underlying at maturity of up to 30%. The table below shows the indicative coupons for this trade utilising the FTSE 100 index compared to those achieved utilising the FTSE CSDI index.

| FTSE 100 Index | FTSE CSDI | |

| Option 1* | 4.65% | 7.15% |

| Option 2** | 5.70% | 9.00% |

| Option 3*** | 7.12% | 11.5% |

*The kick out barrier for Option 1 begins at 102.5% in year two, and is reduced by 2.5% per annum thereafter, down to 82.5% in year ten. **The kick out barrier for Option 2 remains at 100% throughout.

***The kick out barrier for Option 3 remains at 105% throughout.

There are of course, additional considerations to account for, in that whilst the performance of the FTSE CSDI is highly correlated with the FTSE 100 Index, and its performance is expected to be similar, it will inevitably not be identical. The mismatch in performance will be particularly prominent for periods in which the actual dividends paid by the FTSE 100 shares average less than the fixed 3.5% drawdown; for such periods the FTSE 100 Index will outperform the FTSE CSDI. For example, if the annual dividend yield for the weighted FTSE 100 shares is 3% the CDSI will be expected to underperform by 0.5% per annum.

The key features of the Mariana Capital 10:10 Plan November 2020 can be summarised as below (please rely only on the product literature for a full description) …

- Option 1 will mature with a gain of 7.15% for every year the plan has been in force, providing the underlying Index is at or above a reducing reference level on any given observation date. The reference level for year two is 102.5% and this is reduced by 2.5% on each subsequent anniversary, down to 82.5% on the tenth

- Option 2 will mature with a gain of 9% for every year the plan has been force, providing that the underlying Index is at or above its Initial Index Level on any given observation date

- Option 3 will mature with a gain of 11.5% for every year the plan has been force, providing that the underlying Index is at least 5% above its Initial Index Level on any given observation date

- The first early maturity opportunity is on the second anniversary, and annually thereafter

- This is a capital-at-risk autocall plan with a 10-year maximum investment term

- Capital-at-risk protection barrier: 70% of the 6th November 2020 level of the Index

- Capital-at-risk protection barrier observation date: 6th November 2030 (only if not matured sooner)

- Counterparty: Morgan Stanley & Co. International Plc – all returns and return of capital subject to their continued solvency

- Investment start date: 6th November 2020

- Closes 30th October 2020 (14th October 2020 for ISA Transfers), but may become oversubscribed sooner

- Minimum investment is £10,000 only

- Investment method: ISA / ISA transfer, Individual, Joint, SIPP, Trust, Corporate, Partnership

- Individual / Joint gains taxable only if annual gains from all sources exceed £12,300*

For more information regarding the Mariana Capital 10:10 Plan November 2020, and to access the product literature, please visit here.

[1].Source: Bloomberg (16/09/2020). The FTSE CSDI was launched on 01 July 2020 and the charts above therefore include simulated historical performance up to this date. Past performance (actual or simulated) is no indication of future performance and should not be relied upon for investment decisions.

*Capital Gains Tax exemption is £12,300 per individual in the 2020/21 tax year. Gains up to this level are tax free. Where gains from all sources in a tax year exceed the annual Capital Gains Tax exemption, the excess is currently taxed at 10% for basic rate taxpayers and 20% for higher and additional rate taxpayers. Tax rates and reliefs are subject to change.

Structured investments put capital at risk.

Past performance (actual or simulated) is not a guide to future performance.

Disclosure of interests: Lowes has provided input into the concept, development, promotion and distribution of the 10:10. Lowes has a commercial interest in these investments as a result of its involvement. Where Lowes is involved in advice on these investments to retail clients, it will not receive benefit of any fees for its involvement, other than those fees payable by the client to Lowes.

Also in this section

- How old is too old? Are structured products to die for?

- Product focus - October 2024

- Q3 2024 Issuance

- Q3 2024 maturity results

- A share of spread bets on steroids?

- Product focus - September 2024

- Maturities of the month - August 2024

- Right on time

- Product focus - August 2024

- Keep calm and zoom out

- 2,000 and counting

- Q2 2024 maturity results

- 20 years of autocall maturities

- Product focus - June 2024

- Fixed income or interest?

- Maturities of the month - May 2024

- The barrier debate - revisited

- Product focus - April 2024

- Maturities of the month - April 2024

- Time to call

- I don't believe markets are ever too high for Structured products!

- Notes on counterparty exposure

- Return of Nikkei

- Q1 2024 issuance

- Q1 2024 maturity results

- Structured Products – AAAAAGH!

- Hop in CIBC

- Re-enter Santander

- How to build a financial fortune - revisited

- Issuance in 2023

- Where's the risk?

- Questionable offerings

- Challenging the case against structured products - 'Loss of dividends'

- Navigating the investment landscape

- Challenging the case against structured products - Counterparty risk

- 6-year autocalls approaching final destination

- 1,750 FTSE capital at risk autocall maturities

- The leopard that changed her spots

- Q3 2023

- Challenging the case against structured products - Keydata

- Dilemmas for UK IFA's and the unique role of Structured Products

- 'High charges'

- Precipice bonds

- Intro

- FTSE 100 Contingent Income

- Indexing the indices

- Something different

- Investing through volatility

- 100 10:10s

- The best or worst?

- The 10%/25% 'Rule' that never was

- Structured products and the yield curve

- Fixed income: Capital at risk?

- Prospects for UK inflation - and fun with A.I!

- The Barrier Debate

- More Deposits for now

- Last of the Americans

- What if?

- Time heals all wounds, we hope...

- How to diversify portfolios using structured products?

- The Proof Is In The Pudding...

- Debunking Structured Misconceptions

- 1,500 FTSE Capital-at-Risk Autocall Maturities

- Q3 2022 Maturity Results

- What do we prefer?

- Deposits vs Capital ‘Protected’

- There’s time yet…

- Where did you invest your clients?

- A Six-Month Reflection

- Return of the Rev Con

- Happy 2nd Birthday FTSE CSDI

- Q2 2022 Maturity Results

- The best and worst yet still the best

- Critique my Suitability - Mariana 10:10 Plan June 2022 (Option 2)

- 10/10 for 55 10:10’s

- Q1 2022 Maturity Results

- 'How to build a financial fortune': a follow up

- Critique my Suitability - Mariana 10:10 Plan April 2022 (Option 2)

- 2021 Capital-at-Risk Autocall Maturity Review

- An unwelcome return...

- CSDI's First Birthday

- Bon Anniversaire

- Introducing the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index

- Q3 2021 Maturity Results

- Critique my Suitability - Mariana 10:10 Plan October 2021 (Option 2)

- Blurring the lines...

- Beware of false knowledge; it is more dangerous than ignorance

- Good news, bad news...

- Certainty is Certainly a Benefit

- Critique my Suitability - Mariana 10:10 Plan September 2021 (Option 2)

- A Twenty-Year Progression

- Q2 2021 Maturity Results

- Nine 8:8s Post Positive Returns in Falling Markets

- Critique my Suitability

- Q1 2021 Maturity Results

- Morgan Stanley’s Marvelous Maturity Medley

Current Products

We review the UK's retail structured investment sector, providing pertinent support for Professional Advisers and relevant research tools.

View all ⟶