In Spring 2020 financial markets nosedived with the coronavirus pandemic unfolding rapidly, catalysed by global consternation festering and whole countries being ‘locked down’. One of the consequences of such uncertainty was that companies, not least those listed on the FTSE 100 Index, significantly reduced the dividends they paid out, if not stopped them entirely. Throughout 2020, 53 current or former members of the FTSE 100 Index had cut, deferred, or cancelled over £37 billion of dividend payments[1]; the forecasted dividend yield for 2020, as quoted in December 2019, was 4.7%, with the yield in December 2020 falling to 3.2% (AJ Bell)[2].

The decrease in dividend yield, coupled with a heightened degree of uncertainty more generally, made forecasting increasingly difficult to the extent that the banks were building in a greater margin for error. Resultantly, this played a significant role in the coupons offered on FTSE linked structures being substantially lower than pre-pandemic levels. The FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index (FTSE CSDI) was created in July 2020 to offer a solution…

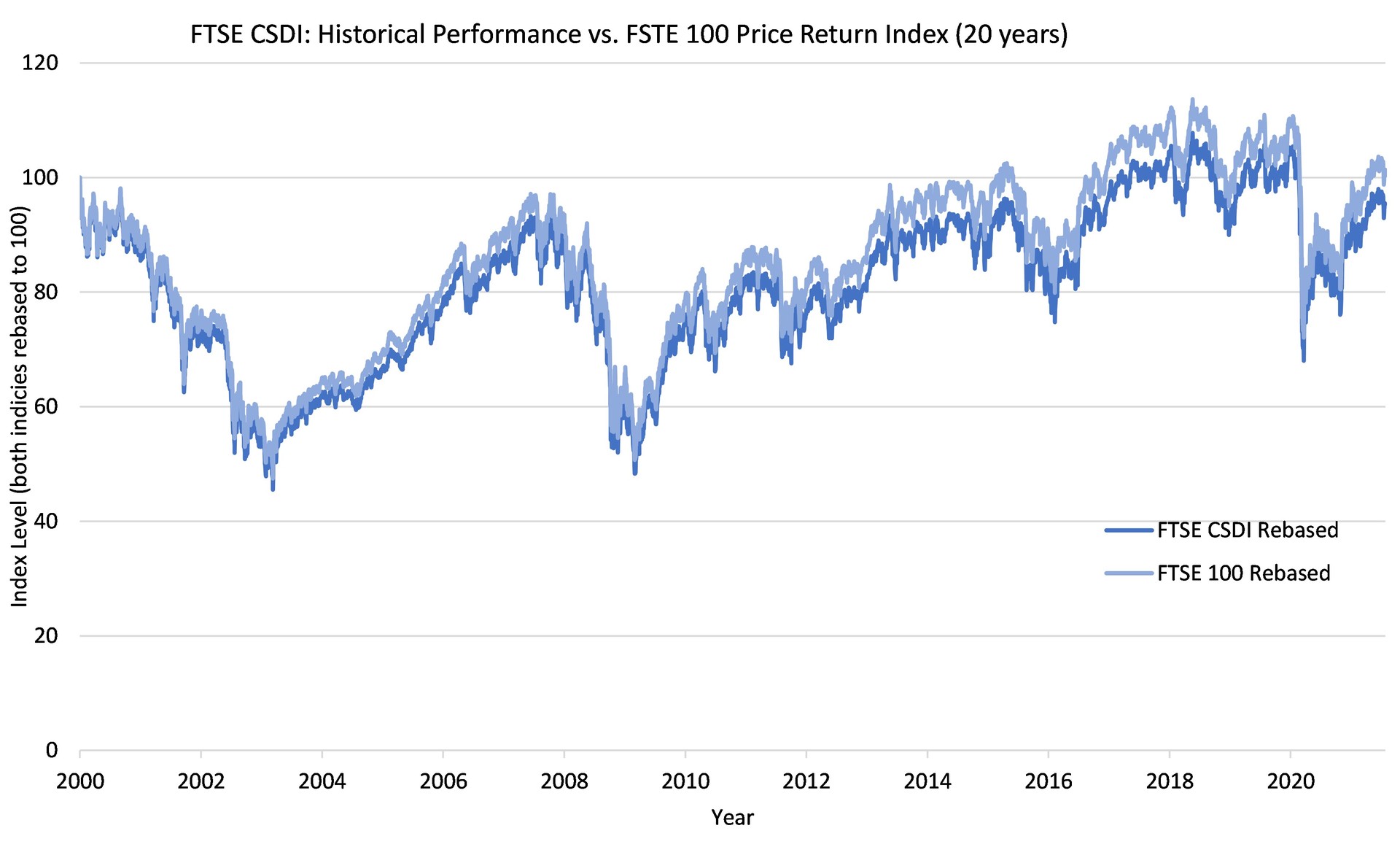

The FTSE CSDI Index was created specifically for structured products by FTSE Russell, the same organisation that calculates and publishes the FTSE 100 Index. The CSDI tracks the same 100 shares but unlike the FTSE 100, the CSDI includes the benefit of the dividends paid by the 100 companies (which have historically averaged around 3.5% per annum) and then deducts the equivalent to a fixed 3.5% dividend per annum, on a daily basis.

As reward for the structured product investor accepting the risk of variability of dividends, the counterparty bank does not have to; the net result is that the returns that can currently be offered on structured products are enhanced by using the CSDI which is around 98% correlated with the FTSE 100 index.

Source: Mariana Capital. The FTSE CSDI was launched on 1 July 2020, and the chart above therefore includes simulated historical performance up until this date.

The result is that the index will perform almost identically to the FTSE 100 if dividends are at 3.5% pa, moderately underperform if they are less, and moderately overperform if they are more.

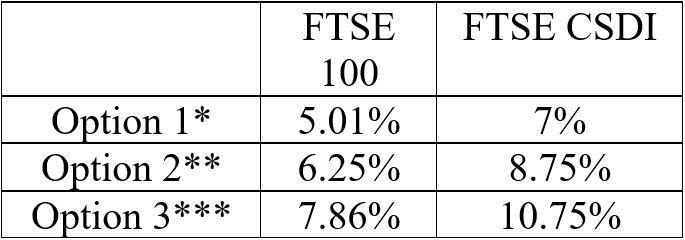

Whilst there will be a draw on the FTSE CSDI relative to the FTSE 100 during periods of dividend yield shortfall below the fixed 3.5% decrement, any shortfall thus far has been negligible, and in any case, we believe that investors are being adequately potentially rewarded for by the increased coupon payable under CSDI contracts, as indicated by the table below. Conversely, if dividends do transpire to be above 3.5% the CSDI will out-perform the FTSE 100 – great if you’re also being compensated for taking the risk that didn’t come to fruition.

*The kick out barrier for Option 1 begins at 102.5% in year two, reducing by 2.5% pa thereafter, down to 82.5% in year ten.

**The kick out barrier for Option 2 remains at 100% throughout.

***The kick out barrier for Option 3 remains at 105% throughout.

The table above shows the indicative coupons offered by Morgan Stanley International PLC at the time of pricing the Mariana 10:10 Plan September 2021[3], utilising the FTSE 100 index compared to those achieved utilising the FTSE CSDI index.

As we begin a steady return to normalcy as a society, financial markets are beginning to follow suit; the forecasted FTSE 100 dividend yield for 2021 is currently 3.7% (AJ Bell)[4], up 0.5% since December 2020.

Although the forecasted yield has improved somewhat, it remains well below pre-pandemic yields, which coupled with lingering socioeconomic uncertainty means that the benefits offered by the FTSE CSDI remain; investors utilizing the CSDI as an underlying take on the risk of variability of dividends so the bank doesn’t have to, which should translate to higher potential coupons on offer than with equivalent FTSE 100 contacts.

If dividends continue to increase, there will of course come a point where the coupons under new CSDI contracts are in line with FTSE 100 contracts – though the dividend yield will likely need to be considerably above the 3.5% decrement in order to outweigh the certainty provided by the CSDI.

For more information on the FTSE CSDI, please see here. A link to the current price of the Index can be accessed via www.Lowes.co.uk/CSDI. Details of the latest Mariana 10:10 and 8:8 Plans, linked to the performance of the FTSE CSDI, can be found here.

Structured investments put capital at risk.

Past performance (actual or simulated) is not a guide to future performance.

Disclosure of interests: Lowes has provided input into the concept, development, promotion and distribution of the 10:10. Lowes has a commercial interest in these investments as a result of its involvement. Where Lowes is involved in advice on these investments to retail clients, it will not receive benefit of any fees for its involvement, other than those fees payable by the client to Lowes.

[1] https://www.ajbell.co.uk/sites/ajbell.co.uk/files/20201210_AJBYI_Dividend_dashboard%20FINAL.pdf

[2] https://www.youinvest.co.uk/articles/investmentarticles/215035/ftse-100-dividends-forecast-grow-109-billion-2021

[3] https://inews.co.uk/inews-lifestyle/money/investing/the-top-10-dividend-payouts-for-2021-tobacco-shell-unilever-bhp-group-1089039

[4] Source: Mariana UFP

Also in this section

- How old is too old? Are structured products to die for?

- Product focus - October 2024

- Q3 2024 Issuance

- Q3 2024 maturity results

- A share of spread bets on steroids?

- Product focus - September 2024

- Maturities of the month - August 2024

- Right on time

- Product focus - August 2024

- Keep calm and zoom out

- 2,000 and counting

- Q2 2024 maturity results

- 20 years of autocall maturities

- Product focus - June 2024

- Fixed income or interest?

- Maturities of the month - May 2024

- The barrier debate - revisited

- Product focus - April 2024

- Maturities of the month - April 2024

- Time to call

- I don't believe markets are ever too high for Structured products!

- Notes on counterparty exposure

- Return of Nikkei

- Q1 2024 issuance

- Q1 2024 maturity results

- Structured Products – AAAAAGH!

- Hop in CIBC

- Re-enter Santander

- How to build a financial fortune - revisited

- Issuance in 2023

- Where's the risk?

- Questionable offerings

- Challenging the case against structured products - 'Loss of dividends'

- Navigating the investment landscape

- Challenging the case against structured products - Counterparty risk

- 6-year autocalls approaching final destination

- 1,750 FTSE capital at risk autocall maturities

- The leopard that changed her spots

- Q3 2023

- Challenging the case against structured products - Keydata

- Dilemmas for UK IFA's and the unique role of Structured Products

- 'High charges'

- Precipice bonds

- Intro

- FTSE 100 Contingent Income

- Indexing the indices

- Something different

- Investing through volatility

- 100 10:10s

- The best or worst?

- The 10%/25% 'Rule' that never was

- Structured products and the yield curve

- Fixed income: Capital at risk?

- Prospects for UK inflation - and fun with A.I!

- The Barrier Debate

- More Deposits for now

- Last of the Americans

- What if?

- Time heals all wounds, we hope...

- How to diversify portfolios using structured products?

- The Proof Is In The Pudding...

- Debunking Structured Misconceptions

- 1,500 FTSE Capital-at-Risk Autocall Maturities

- Q3 2022 Maturity Results

- What do we prefer?

- Deposits vs Capital ‘Protected’

- There’s time yet…

- Where did you invest your clients?

- A Six-Month Reflection

- Return of the Rev Con

- Happy 2nd Birthday FTSE CSDI

- Q2 2022 Maturity Results

- The best and worst yet still the best

- Critique my Suitability - Mariana 10:10 Plan June 2022 (Option 2)

- 10/10 for 55 10:10’s

- Q1 2022 Maturity Results

- 'How to build a financial fortune': a follow up

- Critique my Suitability - Mariana 10:10 Plan April 2022 (Option 2)

- 2021 Capital-at-Risk Autocall Maturity Review

- An unwelcome return...

- CSDI's First Birthday

- Bon Anniversaire

- Introducing the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index

- Q3 2021 Maturity Results

- Critique my Suitability - Mariana 10:10 Plan October 2021 (Option 2)

- Blurring the lines...

- Beware of false knowledge; it is more dangerous than ignorance

- Good news, bad news...

- Certainty is Certainly a Benefit

- Critique my Suitability - Mariana 10:10 Plan September 2021 (Option 2)

- A Twenty-Year Progression

- Q2 2021 Maturity Results

- Nine 8:8s Post Positive Returns in Falling Markets

- Critique my Suitability

- Q1 2021 Maturity Results

- Morgan Stanley’s Marvelous Maturity Medley

Current Products

We review the UK's retail structured investment sector, providing pertinent support for Professional Advisers and relevant research tools.

View all ⟶